Try to say out loud the color of each word without reading the word.

Did you stop trying before you got to the last word?

Try to say out loud the color of each word without reading the word.

Did you stop trying before you got to the last word?

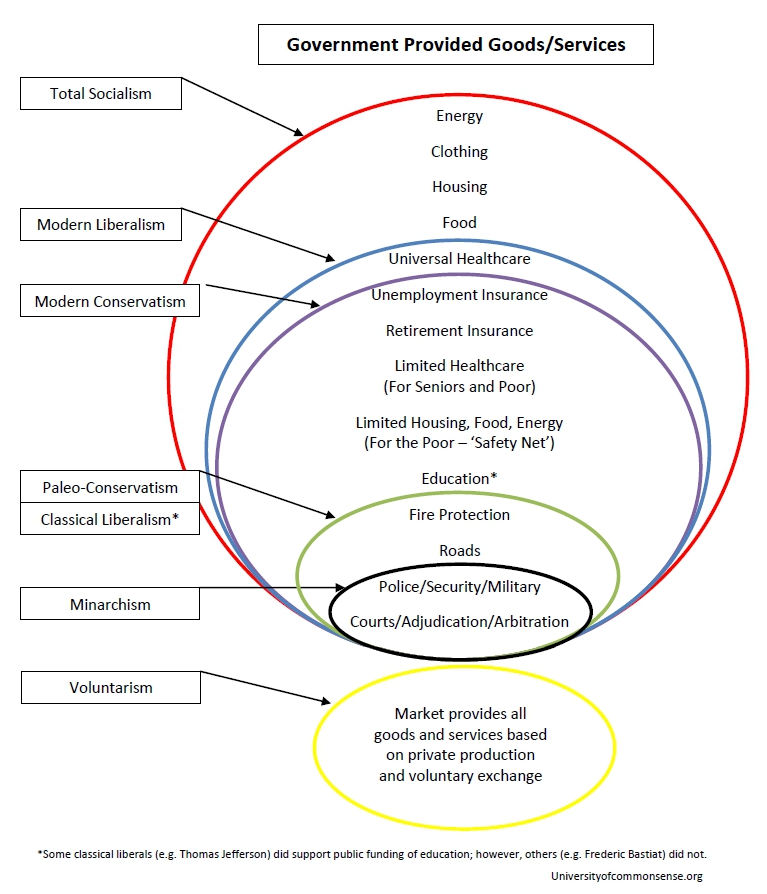

Is it foolish to think that anyone, especially Congress using a political process, can wisely determine where and how much economic aid should be provided to businesses or individuals?

The intended and unintended consequences may be worse than if Congress does nothing.

Reading just headlines some have pointed out that there is an HBR article that says stock buybacks are dangerous for the economy/

https://hbr.org/2020/01/why-stock-buybacks-are-dangerous-for-the-economy

But it is the swapping of equity for debt that is the warning from the HBR article. We have this moral hazard for corporation management because the Federal Reserve is manipulating interest rates. The cost of equity capital for a company is approximately the reciprocal of the P/E ratio. So for a stock with a P/E of 15, the cost of equity capital is 1/15 = 6.6%. With debt capital only costing 3% or less, management is enticed to take on the risk. The problem is that taking on debt requires them to make regular interest payments, while equity capital can suspend dividends whenever they want. Taking on debt to buy back stock is bad. Distributing cash also reduces the a company’s chances to weather a downturn so management needs to consider that before a buyback. But investing the money into growth activities for the company that don’t work out also reduce the safety of the company.

Saw this on Facebook

Bill Evers complied a list of 43 books for the Independent Institute.

Bernie Sanders and others tend to give kudos to China for their spectacular growth. Would the growth have been possible if the west had not already achieved a developed economy? Seems much of China’s growth is due to a process similar to arbitrage. Rather than entrepreneurs having to devise new products for customers, Chinese businessmen only had to figure out how to convert underused human labor into more productive activities. Producing goods for which there were already known customers. Not to disparage what they have done, but rather realize it would not have been possible, if the rest of the world had been at the same level of development as China. Maybe inequality is a good thing for lifting people out of poverty.

In 1891, Pope Leo XIII wrote that “the sources of wealth themselves would run dry, for no one would have any interest in exerting his talents or his industry; and that ideal equality about which they entertain pleasant dreams would be in reality the leveling down of all to a like condition of misery and degradation. Hence, it is clear that the main tenet of socialism, community of goods, must be utterly rejected, since it only injures those whom it would seem meant to benefit, is directly contrary to the natural rights of mankind, and would introduce confusion and disorder into the commonweal.”

From: https://www.libertarianism.org/columns/both-catholic-libertarian-is-it-really-possible

A recent podcast interview with Prof. Nickolas Christakis titled Evolution of Cooperation brought to mind a 1984 book by Robert Axelrod

Here are some pdf’s related to the book.